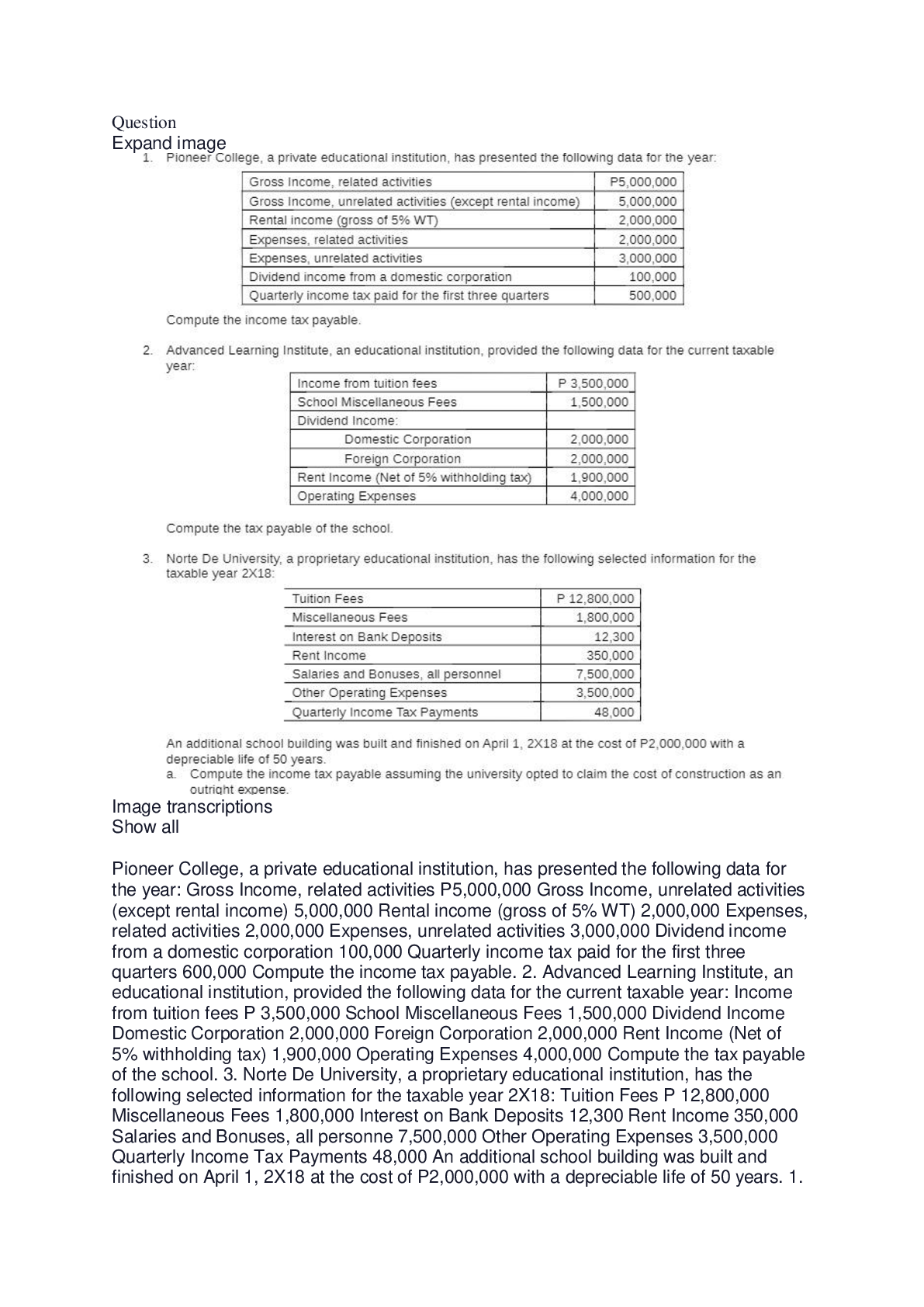

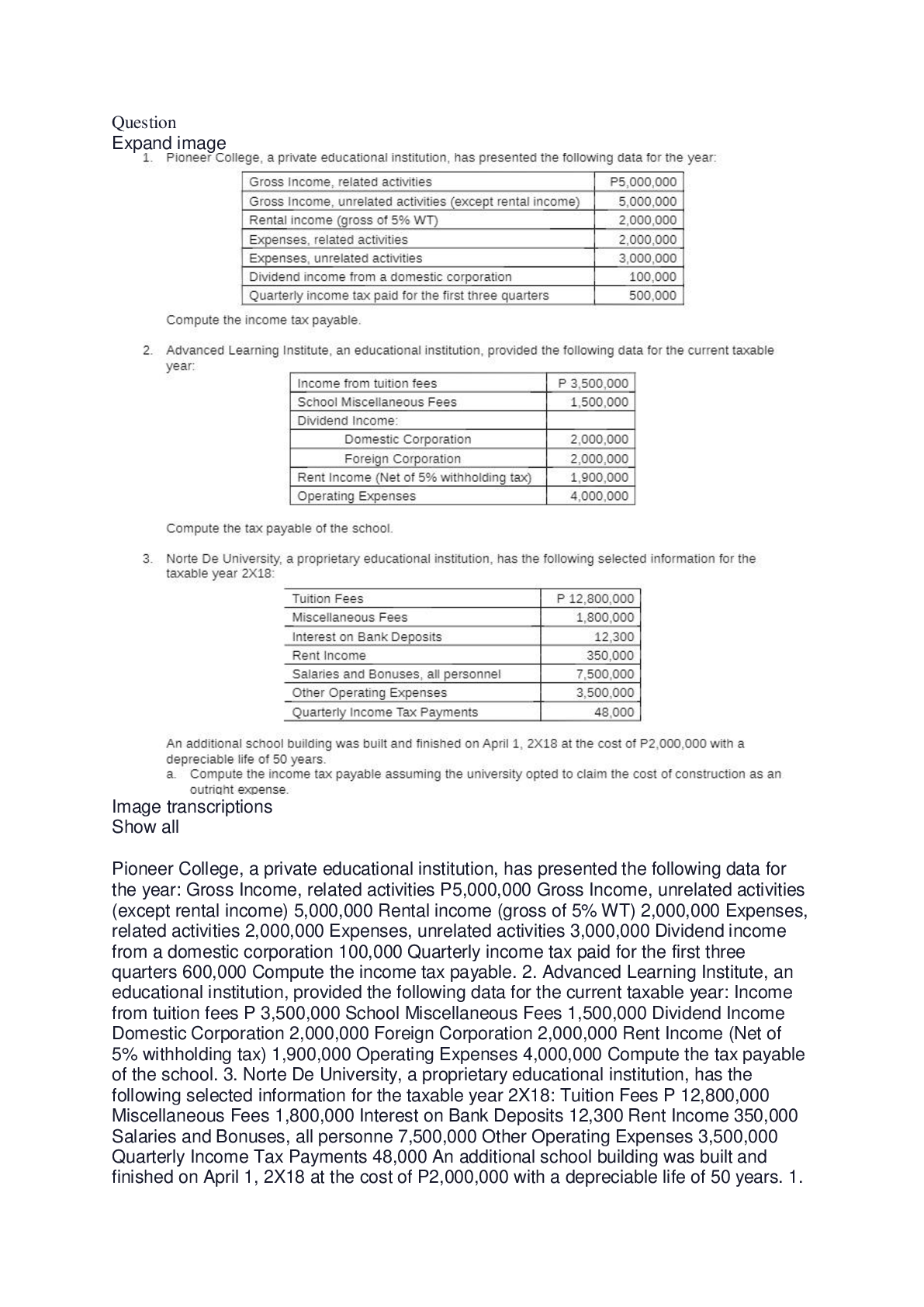

Business Accounting Pioneer College, a private educational institution, has presented the following data for the year

Course

Engineering

Subject

Chemistry

Category

Questions and Answers

Pages

7

Uploaded By

ATIPROS

Preview 2 out of 7 Pages

Download all 7 pages for $ 6.63

Reviews (0)

$6.63