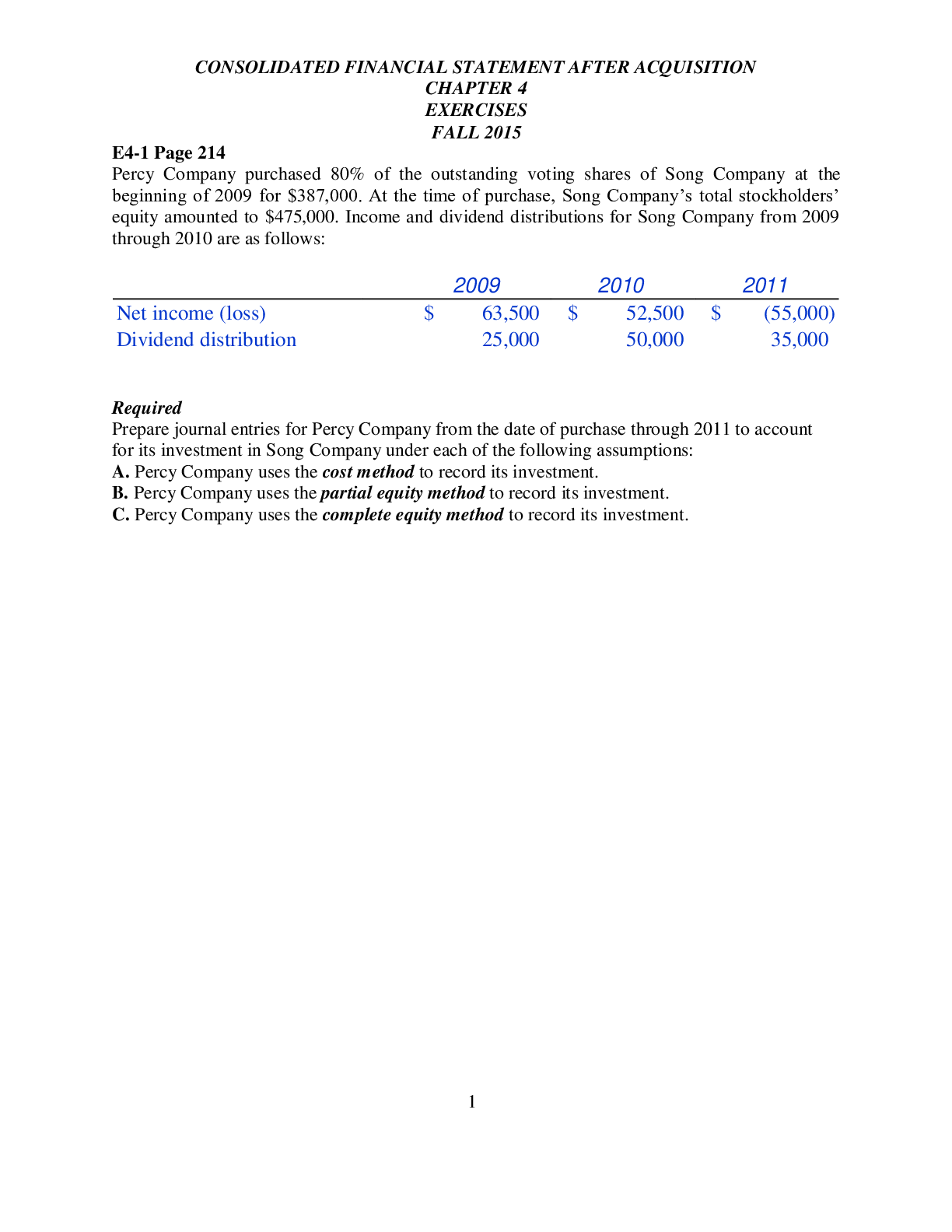

CONSOLIDATED FINANCIAL STATEMENT AFTER ACQUISITION CHAPTER 4 EXERCISES FALL 2015

Course

Engineering

Subject

Chemistry

Category

Questions Only

Pages

10

Uploaded By

ATIPROS

Preview 2 out of 10 Pages

Download all 10 pages for $ 6.50

Reviews (0)

$6.50