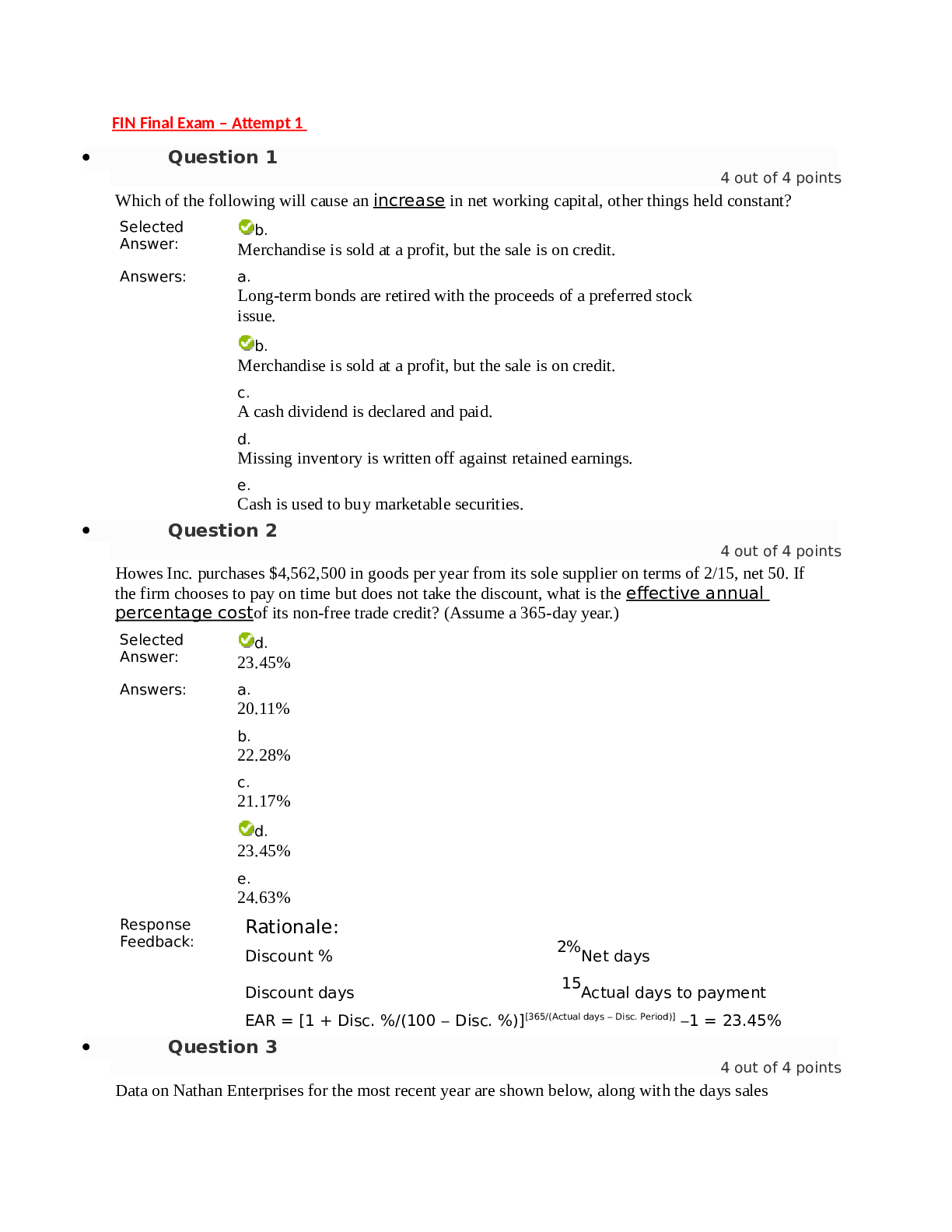

FIN Final Exam – Attempt 1

Question 1

4 out of 4 points

Which of the following will cause an increase in net working capital, other things held constant?

Selected

Answer:

b.

Merchandise is sold at a profit, but the sale is on credit.

Answers:

a.

Long-term bonds are retired with the proceeds of a preferred stock

issue.

b.

Merchandise is sold at a profit, but the sale is on credit.

c.

A cash dividend is declared and paid.

d.

Missing inventory is written off against retained earnings.

e.

Cash is used to buy marketable securities.

Question 2

4 out of 4 points

Howes Inc. purchases $4,562,500 in goods per year from its sole supplier on terms of 2/15, net 50. If

the firm chooses to pay on time but does not take the discount, what is the effective annual

percentage costof its non-free trade credit? (Assume a 365-day year.)

Selected

Answer:

d.

23.45%

Answers:

a.

20.11%

b.

22.28%

c.

21.17%

d.

23.45%

e.

24.63%

Response

Rationale:

Feedback:

2%

Discount %

Net days

15

Discount days

Actual days to payment

EAR = [1 + Disc. %/(100 − Disc. %)][365/(Actual days − Disc. Period)] −1 = 23.45%

Question 3

4 out of 4 points

Data on Nathan Enterprises for the most recent year are shown below, along with the days sales

outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company

could reduce its receivables enough to reduce its DSO to the benchmarks' average. If this were done,

by how much would receivables decline? Use a 365-day year.

Sales

Accounts receivable

Days sales outstanding (DSO)

Benchmark days sales outstanding

(DSO)

Selected

b.

Answer:

$9,973

Answers:

a.

$10,970

b.

$9,973

c.

$8,078

d.

$12,067

e.

$8,975

Response

Rationale:

Feedback:

$110,000

$16,000

53.09

20.00

Original

Data

$110,000

Sales

$16,000

Receivables and DSO

New receivables =

DSO × (Sales/365) =

Reduction in receivables = Original

receivables − New receivables =

Benchmark

Receivables at

Benchmark

Related DSO

DSO

Level

53.09

20.00

$6,027

$9,973

Alternative solution:

(Change in DSO/Original DSO) × Orig.

$9,973

receivables =

Question 4

4 out of 4 points

BLW Corporation is considering the terms to be set on the options it plans to issue to its executives.

Which of the following actions would decrease the value of the options, other things held constant?

Selected

a.

Answer:

The exercise price of the option is increased.

Read More

.png)