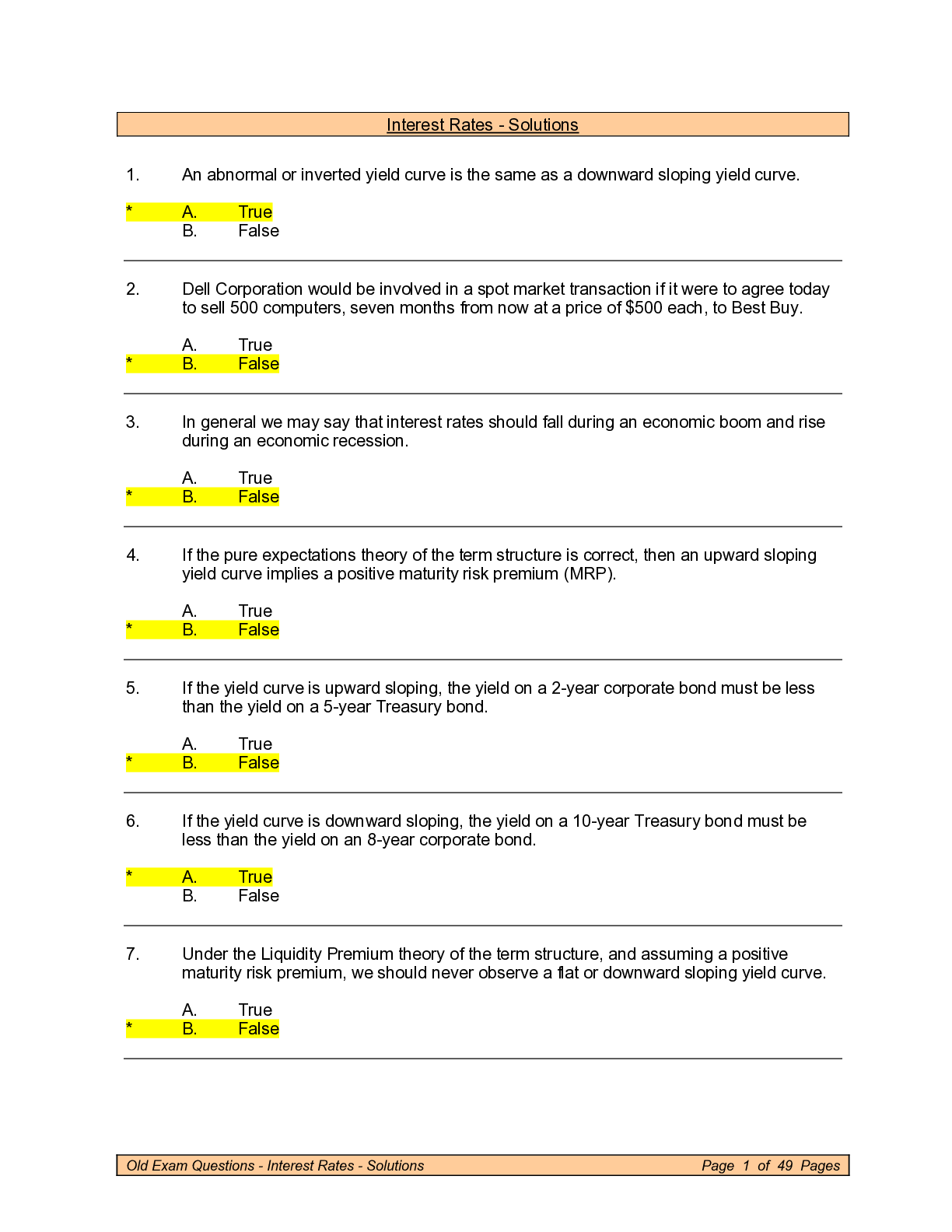

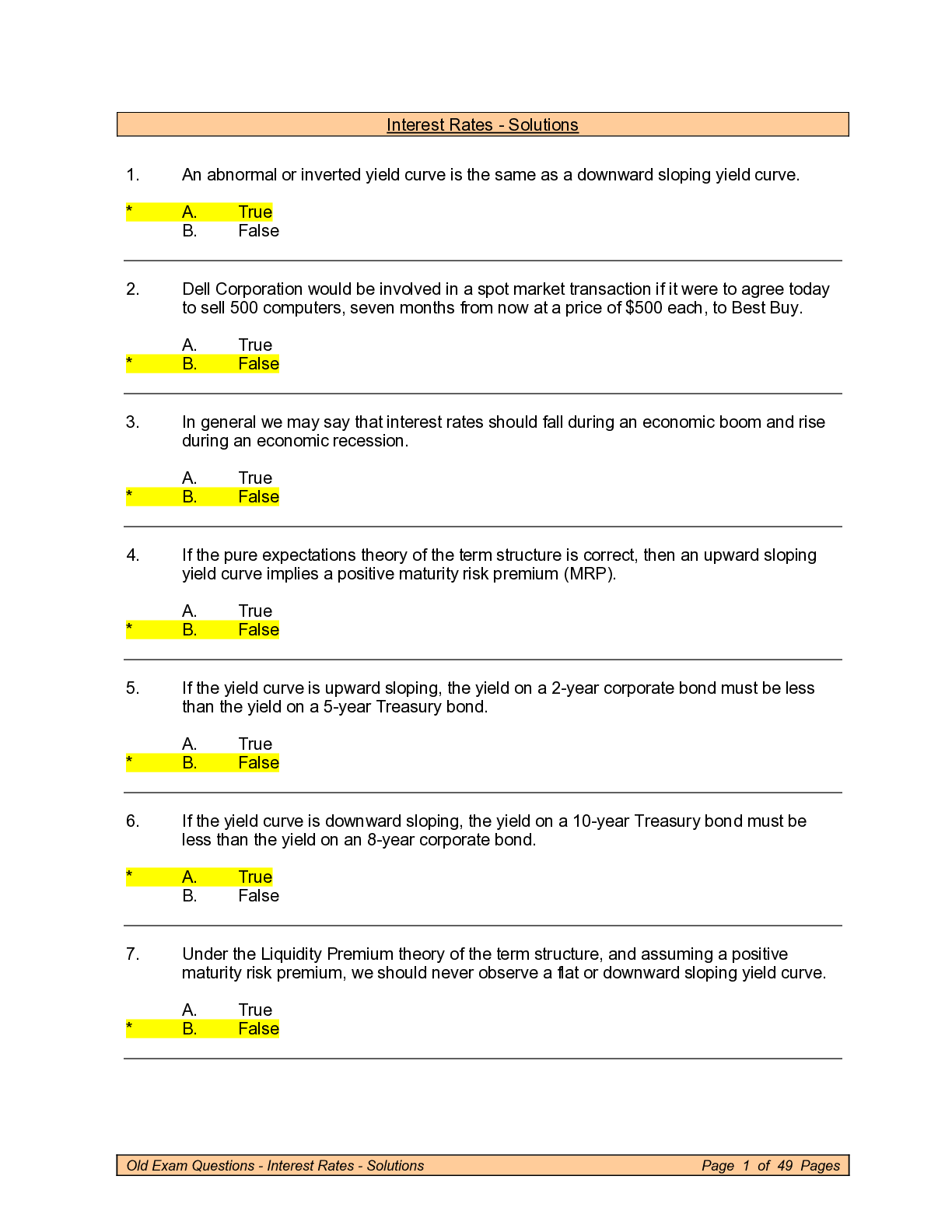

Interest Rates - Solutions (Fall 2009)

Course

Engineering

Subject

Chemistry

Category

Questions and Answers

Pages

49

Uploaded By

ATIPROS

Preview 5 out of 49 Pages

Download all 49 pages for $ 14.00

Reviews (0)

$14.00