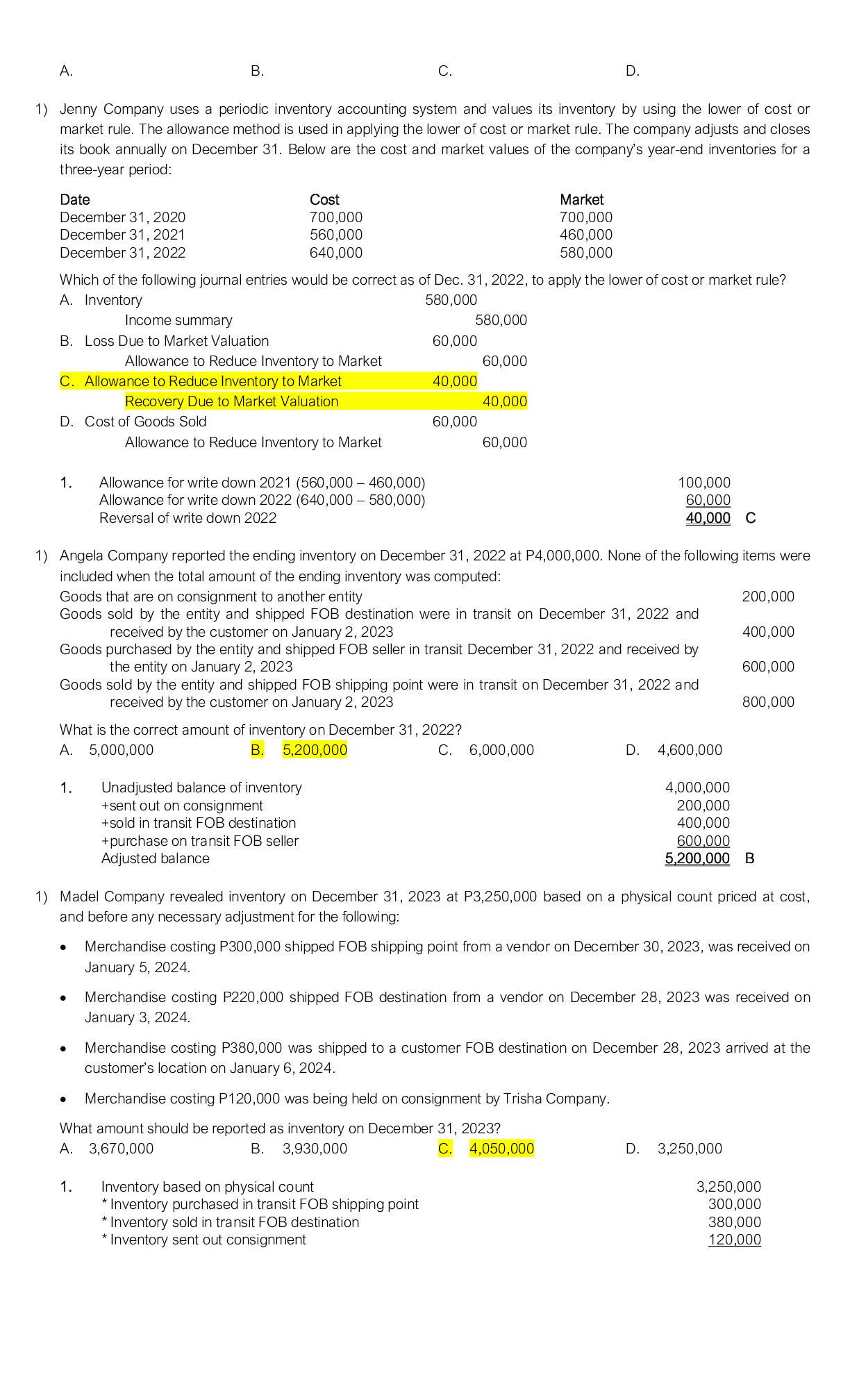

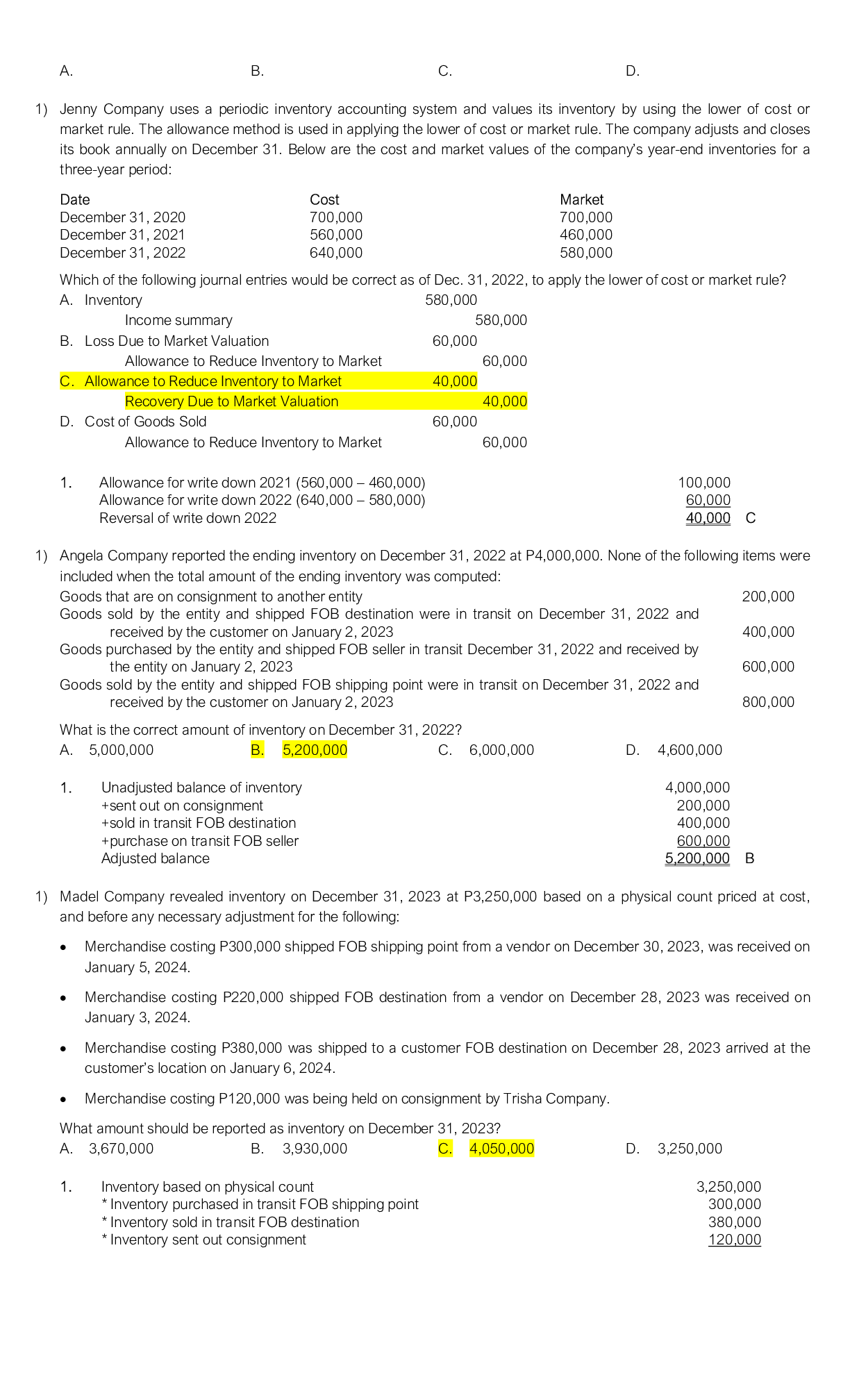

enny Company uses a periodic inventory accounting system and values its inventory by using the lower of cost or

market rule. The allowance method is used in applying the lower of cost or market rule. The company adjusts and closes

its book annually on December 31. Below are the cost and market values of the company’s year-end inventories for a

three-year period:

Date

December 31, 2020

December 31, 2021

December 31, 2022

Cost

700,000

560,000

640,000

Market

700,000

460,000

580,000

Which of the following journal entries would be correct as of Dec. 31, 2022, to apply the lower of cost or market rule?

A. Inventory

580,000

Income summary

580,000

B. Loss Due to Market Valuation

60,000

Allowance to Reduce Inventory to Market

60,000

C. Allowance to Reduce Inventory to Market

40,000

Recovery Due to Market Valuation

40,000

D. Cost of Goods Sold

60,000

Allowance to Reduce Inventory to Market

60,000

1.

Allowance for write down 2021 (560,000 – 460,000)

Allowance for write down 2022 (640,000 – 580,000)

Reversal of write down 2022

100,000

60,000

40,000

C

1)Angela Company reported the ending inventory on December 31, 2022 at P4,000,000. None of the following items were

included when the total amount of the ending inventory was computed:

Goods that are on consignment to another entity

200,000

Goods sold by the entity and shipped FOB destination were in transit on December 31, 2022 and

received by the customer on January 2, 2023

400,000

Goods purchased by the entity and shipped FOB seller in transit December 31, 2022 and received by

the entity on January 2, 2023

600,000

Goods sold by the entity and shipped FOB shipping point were in transit on December 31, 2022 and

received by the customer on January 2, 2023

800,000

What is the correct amount of inventory on December 31, 2022?

A. 5,000,000

B. 5,200,000

C. 6,000,000

D.

4,600,000

1.

Unadjusted balance of inventory

+sent out on consignment

+sold in transit FOB destination

+purchase on transit FOB seller

Adjusted balance

4,000,000

200,000

400,000

600,000

5,200,000

B

1) Madel Company revealed inventory on December 31, 2023 at P3,250,000 based on a physical count priced at cost,

and before any necessary adjustment for the following:

Merchandise costing P300,000 shipped FOB shipping point from a vendor on December 30, 2023, was received on

January 5, 2024.

Merchandise costing P220,000 shipped FOB destination from a vendor on December 28, 2023 was received on

January 3, 2024.

Merchandise costing P380,000 was shipped to a customer FOB destination on December 28, 2023 arrived at the

customer’s location on January 6, 2024.

Merchandise costing P120,000 was being held on consignment by Trisha Company.

What amount should be reported as inventory on December 31, 2023?

A. 3,670,000

B. 3,930,000

C. 4,050,000

D.

3,250,000

1.

Inventory based on physical count

* Inventory purchased in transit FOB shipping point

* Inventory sold in transit FOB destination

* Inventory sent out consignment

Read More