Question 1

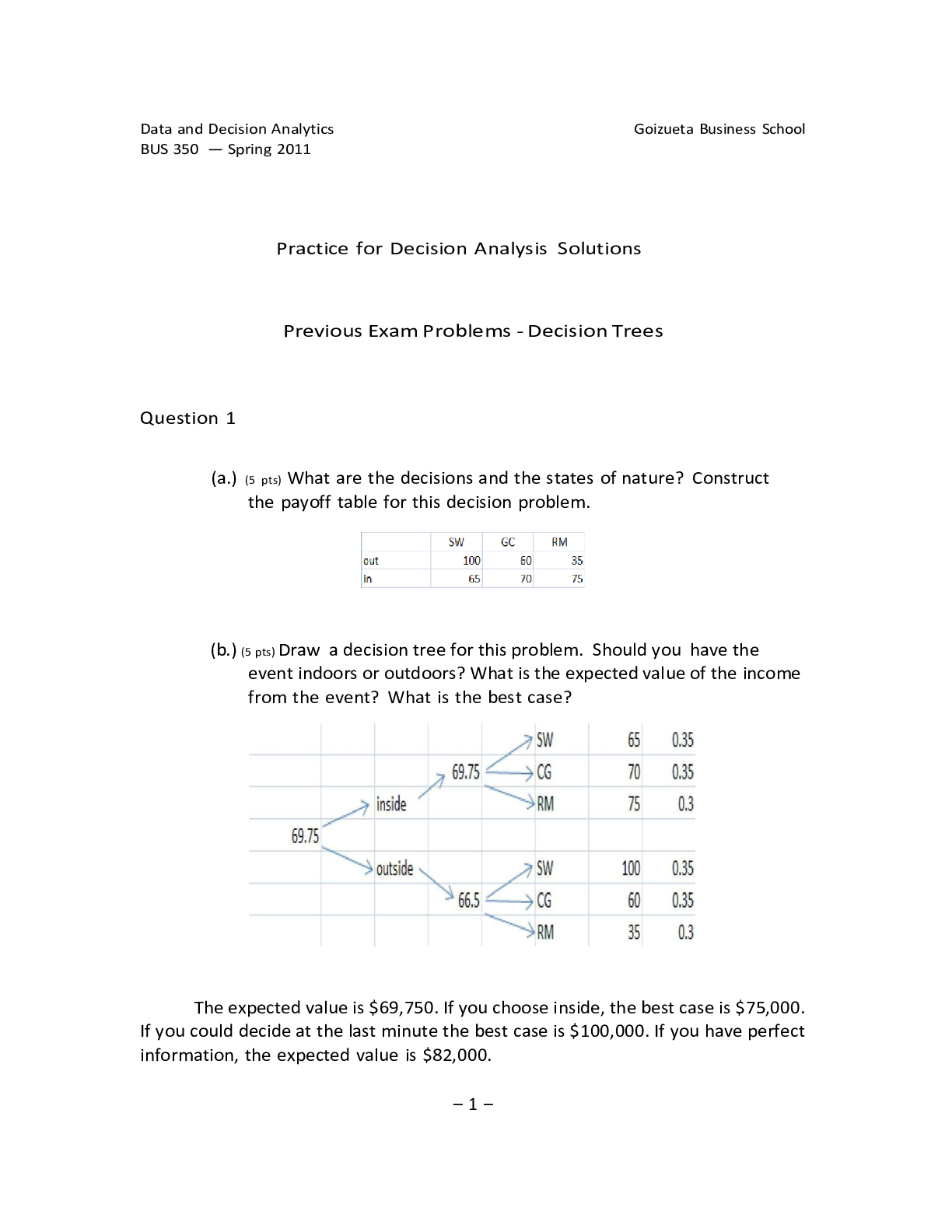

(a.) (5 pts) What are the decisions and the states of nature? Construct

the payoff table for this decision problem.

(b.) (5 pts) Draw a decision tree for this problem. Should you have the

event indoors or outdoors? What is the expected value of the income

from the event? What is the best case?

The expected value is $69,750. If you choose inside, the best case is $75,000.

If you could decide at the last minute the best case is $100,000. If you have perfect

information, the expected value is $82,000.

–1–

BUS 350 Practice for Decision Analysis Solutions

(c.) (5 pts) Given your prior probability estimates about the weather,

what is the chance that there will be an approaching cold front three

days prior to the event?

Here are the probability calculations:

(d.) (5 pts) When you get to three days prior to the event, if you see

an approaching cold front, what is the probability that it will be a

sunny and warm day for the event? If there is no front, what is the

probability that the day of the event it will be a rainy and miserable

day?

Here are the conditional probability calculations:

(e.) (5 pts) Draw a decision tree for the event if you decide to take the

option on the indoor space. What is the best decision policy now?

–2–

BUS 350 Practice for Decision Analysis Solutions

If there’s a cold front, keep the inside reservation. But if there is not, cancel

the inside and have the outside.

(f.) (5 pts) Is it worth the $1,000 to have the option of cancelling?

Suppose you could get the option to cancel the day of the event,

when you would know the weather. How much (on average) would

that increase the amount of money you could raise from the event?

The expected value is $74,375, which is more than the no information value

of $69,750, even paying the extra $1,000. If we could wait until the day of the

event, then we would have “perfect information” and would choose outside if SW

but inside if GC or RM. The expected value is $82,000, which is $12,250 more than

no information, and $7,625 more than the three-day option.

Question 2

(a.) (5 pts) What decision options do you have? What states of nature are

possible (given your assumptions)?

The decisions are the three lease options, L1, L2 and L3. The states of

nature are the miles you will end up driving the next year. What kind of job you

will have is not necessary for the decision tree at this point.

(b.) (5 pts) For each lease option, what are the possible payoffs for each of

the states of nature?

Here are the payoffs for the four quiz versions:

–3–

BUS 350 Practice for Decision Analysis Solutions

(c.) (5 pts) Which outcome causes the cost of the lease to be the greatest?

What is the situation where the cost of the lease is the minimum?

Does this help you choose between the three lease options?

The greatest cost comes from the highest mileage under lease L3. The least

cost comes from the lowest mileage, also under lease L3. So this lease could be the

best or the worst outcome, and so might be a risky choice. Conversely, it appears

that lease L2 is the least risky.

(d.) (5 pts) Draw a decision tree for the lease choice problem. What lease

option should you choose?

Here is the exam 1 solution1:

Read More